Online MBA in Finance Management – MAHE Manipal University

- Who should pursue an MBA in Finance Management?

- Can i get a Job Promotion after online MBA degree courses?

- What jobs can I get after MBA in Finance Management?

- What are the benefits of an MBA in finance management?

- What is the average salary after MBA in Finance Management?

Online MBA in Finance Management - MAHE Manipal University

- Who should pursue an MBA in Finance Management?

- Can i get a Job Promotion after online MBA degree courses?

- What jobs can I get after MBA in Finance Management?

- What are the benefits of an MBA in Finance Management?

- What is the average salary after MBA in Finance Management?

Online MBA in Finance Management Program Overview

The Online MBA in Finance is a two-year, four-semester online programme offered by Online Manipal University. It is specially curated for working professionals and aspiring finance leaders. Delivered through a robust digital learning platform, the programme allows learners to:

- Gain expertise in finance, investments, and corporate strategy.

- Strengthen managerial and decision-making skills.

- Balance work, life, and studies with flexible online learning.

The programme builds a strong foundation in finance, strategy, and management, opening doors to senior roles in the BFSI and corporate sectors.

Total Fees

INR 1,75,000/-

Fees Per Semester

INR 43,750/-

EMI Available

With 0% Interest Rate

Course Duration

24 Months

Online MBA in Finance Management Program Overview

The Online MBA in Finance is a two-year, four-semester online program offered by MAHE Manipal University. It is specially curated for working professionals and aspiring finance leaders. Delivered through a robust digital learning platform, the programme allows learners to:

- Gain expertise in finance, investments, and corporate strategy.

- Strengthen managerial and decision-making skills.

- Balance work, life, and studies with flexible online learning.

The programme builds a strong foundation in finance, strategy, and management, opening doors to senior roles in the BFSI and corporate sectors.

Total Fees

INR 1,75,000/-

Fees Per Semester

INR 43,750/-

EMI Available

With 0% Interest Rate

Course Duration

24 Months

Who Should Pursue an Online MBA in Finance Management?

An Online MBA Degree Course in Finance Management is ideal for individuals who want to:

- Working Professionals

- People living in remote areas

- Freelancers

- Entrepreneurs

- Students planning to switch career

- Candidates looking for Job Promotion

Why to Pursue an Online MBA Degree Course in Finance Management?

By 2050, finance leaders will not just manage money—they will shape economies. With MAHE Manipal University’s MBA in Finance Management, graduates will be equipped to drive digital innovation, global investment strategies, and corporate decision-making.

Key benefits include:

- UGC-entitled degree recognized globally.

- Flexible online learning with live and recorded classes.

- Digital-first experience with e-learning resources and industry exposure.

- Placement assistance with leading recruiters in BFSI and corporate sectors.

Why to Pursue an Online MBA Degree Course in Finance Management?

By 2050, finance leaders will not just manage money—they will shape economies. With MAHE Manipal University’s MBA in Finance Management, graduates will be equipped to drive digital innovation, global investment strategies, and corporate decision-making.

Key benefits include:

- UGC-entitled degree recognized globally.

- Flexible online learning with live and recorded classes.

- Digital-first experience with e-learning resources and industry exposure.

- Placement assistance with leading recruiters in BFSI and corporate sectors.

Fee Structure

Attractive Scholarships Available

Program Structure by Semester

Our 4-semester program is carefully structured to build your knowledge progressively, from foundational concepts to advanced specializations.

Semester 1

- Entrepreneurial Practice

- Business Communication (WAC)

- Managerial Economics

- Financial Accounting

- Data Visualisation (Excel/Tableau)

- Organizational Behaviour

- Marketing Management

Semester 2

- Business Research Methods (R/Python)

- Operation Management

- Human Resource Management

- Management Accounting

- Financial Management

- Legal Aspects of Business

- Business Communication (VAC)

Semester 3

Core Subjects

- Strategic Management

- Term Paper

Electives/Specializations subjects

- Security Analysis and Portfolio Management

- Mergers and Acquisitions

- Taxation Management

- Internal Audit and Control

Semester 4

Core Subjects

- International Business Management

- Project

Electives/Specializations subjects

- International Financial Management

- Treasury Management

- Merchant Banking and Financial Services

- Insurance and Risk Management

What Skills will you learn in Finance management?

Skills and Careers in 2025 after Complete Online MBA in Finance Management from Manipal University

Skills of the Future

- Strategic financial planning – Mastering accounting, reporting, and economic analysis

- Decision-making and problem-solving – Leveraging data and logical reasoning

- Global business perspective – Adapting to cross-border financial challenges

- Innovation and technology adoption – Using digital tools for smarter finance management

- Leadership and time management – Balancing high-pressure roles with effective execution

Careers With MBA Finance

- Risk Management – Identifying and mitigating financial risks

- Banking & FinTech – Roles like digital banking manager or payment solutions analyst

- Investment & Wealth Advisory – Guiding individuals and businesses on investments

- Compliance & Governance – Ensuring regulatory and ethical financial practices

- Corporate Finance & Strategy – Supporting businesses in raising capital and making strategic decisions

Online MBA in Finance Management: Eligibility & Duration

Understand the entry requirements and program length before you enroll in the Online MBA in Finance Management at Manipal University Online.

Requirements for the Online MBA in Finance Management

- Graduation degree (10+2+3 or equivalent) from a recognized university with at least 50% marks (45% for reserved categories).

- No mandatory work experience required, but professional experience is beneficial.

- No entrance exam like CAT, MAT, XAT, or GMAT required for admission; however, the university may conduct its own aptitude test if needed.

Duration of the Online MBA in Finance Management

The program is designed to be completed in 2 years (4 semesters), delivered entirely online for maximum flexibility—ideal for working professionals and recent graduates alike.

Career Growth and Opportunity

Our track record speaks for itself – delivering exceptional outcomes for finance professionals worldwide.

98%

Job Placement Rate

50k

Average Starting Salary

85%

Salary Increase

500+

Alumni Network

| Job Role | Average Salary (per year in INR) | Industries Hiring |

|---|---|---|

| Investment Banker | ₹12 LPA – ₹30 LPA+ | Banking, Financial Services, Consulting |

| Financial Analyst | ₹6 LPA – ₹12 LPA | BFSI, Corporate Finance, IT, Consulting |

| Risk Manager | ₹10 LPA – ₹22 LPA | Insurance, Banking, Asset Management |

| Corporate Finance Manager | ₹9 LPA – ₹20 LPA | MNCs, Manufacturing, IT, Real Estate |

| Equity Research Analyst | ₹7 LPA – ₹15 LPA | Investment Firms, Stock Market, Asset Management |

| Treasury Manager | ₹8 LPA – ₹18 LPA | Banks, MNCs, Global Corporations |

| Credit Manager | ₹6 LPA – ₹14 LPA | Banking, NBFCs, Microfinance |

| Financial Planner / Wealth Manager | ₹7 LPA – ₹16 LPA | Wealth Management Firms, Private Banking, FinTech |

Our Other MBA Specialization

In addition to Finance, we offer a wide range of MBA specializations designed to match diverse professional goals and industry demands.

| Course Name | Duration | Registration Fees | Total Fees |

|---|---|---|---|

| Online MBA in Finance Management | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Digital Marketing | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Marketing Management | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Human Resource Management (HRM) | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Analytics and Data Science | 2 Years | 500/- | 1,75,000/- |

| Online MBA in BFSI | 2 Years | 500/- | 1,75,000/- |

| Online MBA in IT and FinTech | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Operation Management | 2 Years | 500/- | 1,75,000/- |

| Online MBA in International Business | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Information System Management | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Project Management | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Supply Chain Management | 2 Years | 500/- | 1,75,000/- |

| Online MBA in Retail Management | 2 Years | 500/- | 1,75,000/- |

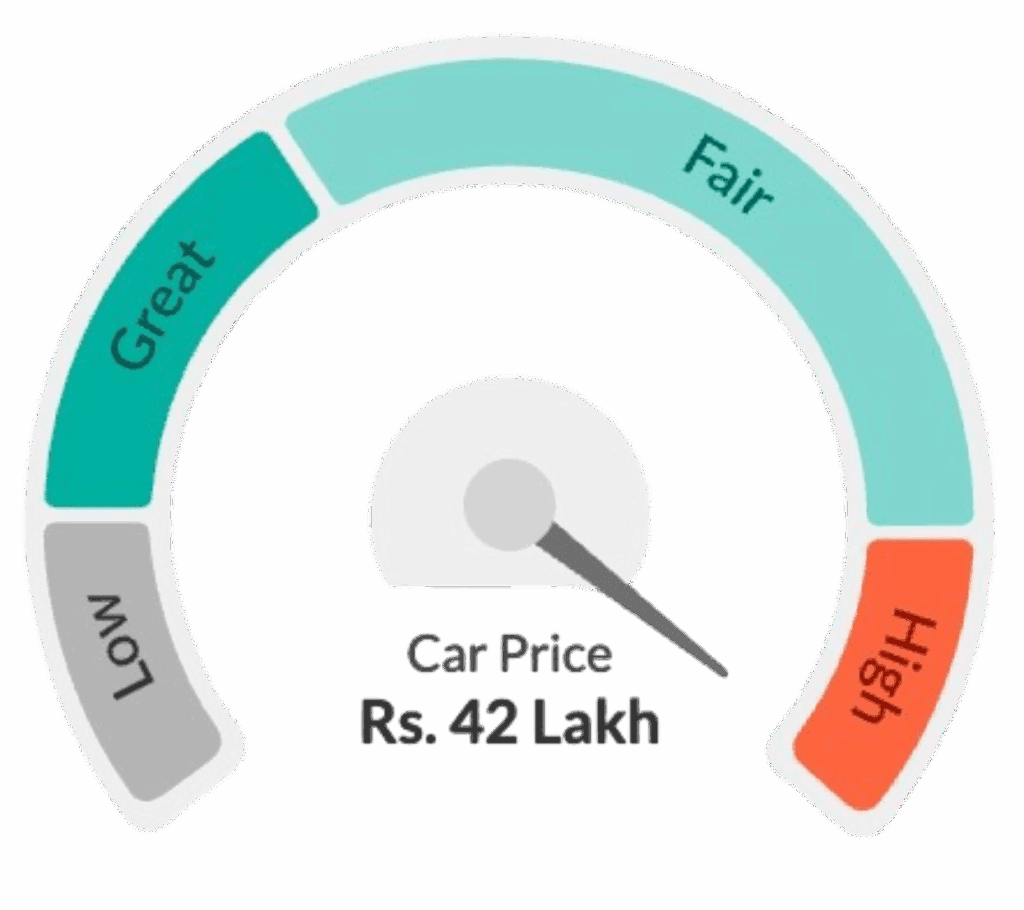

Price Guide

The cost of an online MBA in Finance Management ranges from $10,000 to $120,000, influenced by factors such as university ranking, program duration, curriculum, and geographical location.

AccuPrice by ecampus

Average MBA Price

Rs. 1.50 – 5.00 Lakh

Average MBA Price

Rs. 1.50 – 5.00 Lakh

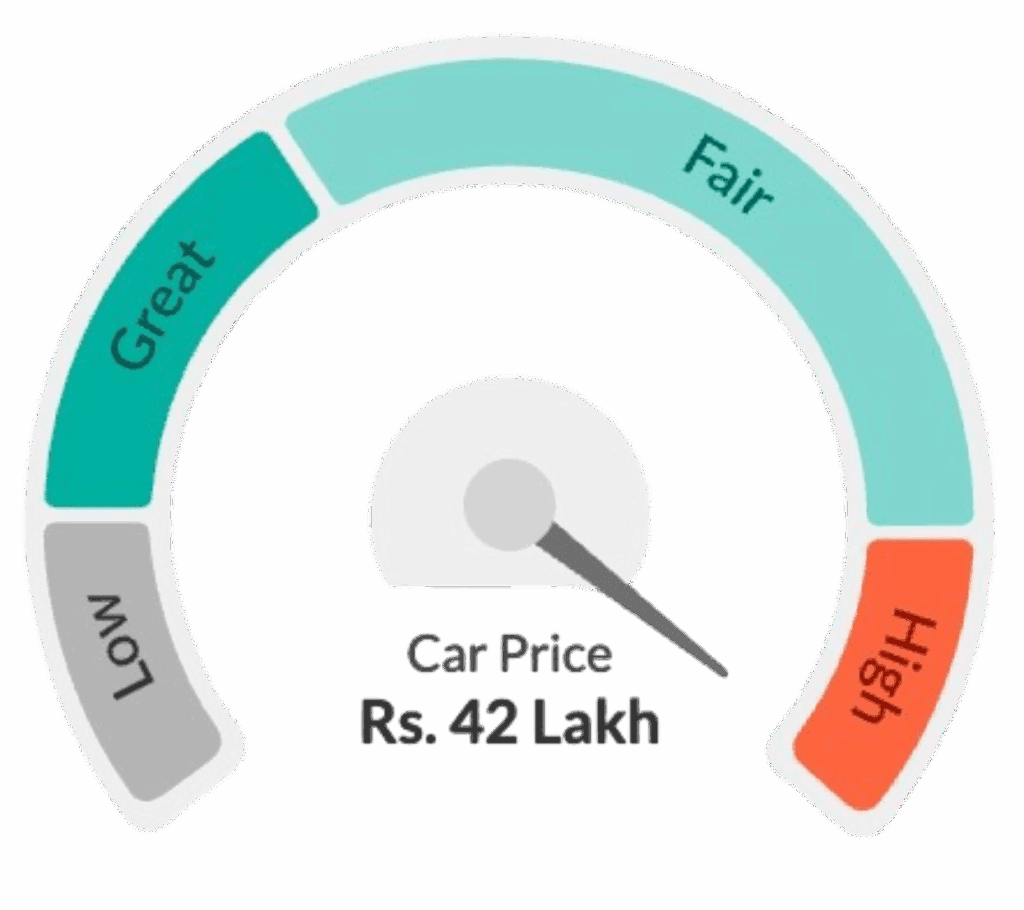

Price Guide

The cost of an online MBA in Finance Management ranges from $10,000 to $120,000, influenced by factors such as university ranking, program duration, curriculum, and geographical location.

AccuPrice

by ecampus

Average MBA Price

Rs. 1.50 – 5.00 Lakh

Average MBA Price

Rs. 1.50 – 5.00 Lakh

Success Stories: What Students say about it

Frequently Asked Question

An MBA in Finance Management is a postgraduate degree that focuses on financial planning, control, and decision-making within organizations. It covers subjects like financial analysis, investment management, corporate finance, risk management, and international finance.

Most universities require candidates to have a bachelor’s degree in any discipline with a minimum aggregate score (usually 50% or above). Many institutions also require qualifying entrance exams such as CAT, GMAT, XAT, or GRE, followed by group discussions and personal interviews.

Key subjects include Financial Accounting, Corporate Finance, Investment Analysis, Portfolio Management, Financial Markets, Risk Management, Derivatives, and International Financial Management.

Graduates can pursue careers as Financial Analysts, Investment Bankers, Portfolio Managers, Corporate Finance Managers, Risk Analysts, Financial Consultants, or Chief Financial Officers (CFOs) in banks, investment firms, corporations, and financial institutions.

Analytical thinking, quantitative skills, problem-solving, attention to detail, knowledge of financial software and modeling, and strong communication skills are essential for success in finance-related roles.

Salaries vary depending on experience, role, and location. On average, fresh MBA Finance graduates can expect annual packages ranging from ₹6–12 lakhs in India (or $70,000–$120,000 internationally), with higher pay as experience and expertise increase.